Simplicity Digital Advisor

A Recap: Significant 2024 Retirement Savings Changes

The landscape of retirement savings in the United States is experiencing crucial changes following newly enacted legislative changes for 2024. These updates and reforms seek to enhance the flexibility of retirement savings accounts. They also seek to transform how Americans save and prepare for retirement. Here are some of the more significant changes this year.

Politics, Elections, and Your Retirement Savings

To truly grasp how politics and elections may impact retirement savings, it’s necessary to consider multiple dimensions. Elections, policy changes, geopolitical events, and even political rhetoric can influence economic activities, indirectly affecting the financial markets. Therefore, understanding the correlation between these domains is critical. And necessary in making informed decisions regarding elections and your retirement savings. Here are the areas that may be impacted.

5 Tips to Save Money During Back-to-School Season

The back-to-school season can be an expensive affair for families. Purchasing new backpacks, school supplies, clothes, and other necessities can significantly dent the family budget. However, you can effectively navigate this potentially costly period by implementing strategic planning and a few money-saving tactics while covering all your children’s needs. Here are five tips to save money during the back-to-school season.

7 Smart Strategies to Pay Off Your Mortgage Ahead of Schedule

You as a homeowner may strive to pay off your mortgage ahead of schedule. This goal gives them the confidence that comes with owning their home outright and can save them significant money in interest payments over the long term. Here are seven smart strategies to work toward this goal.

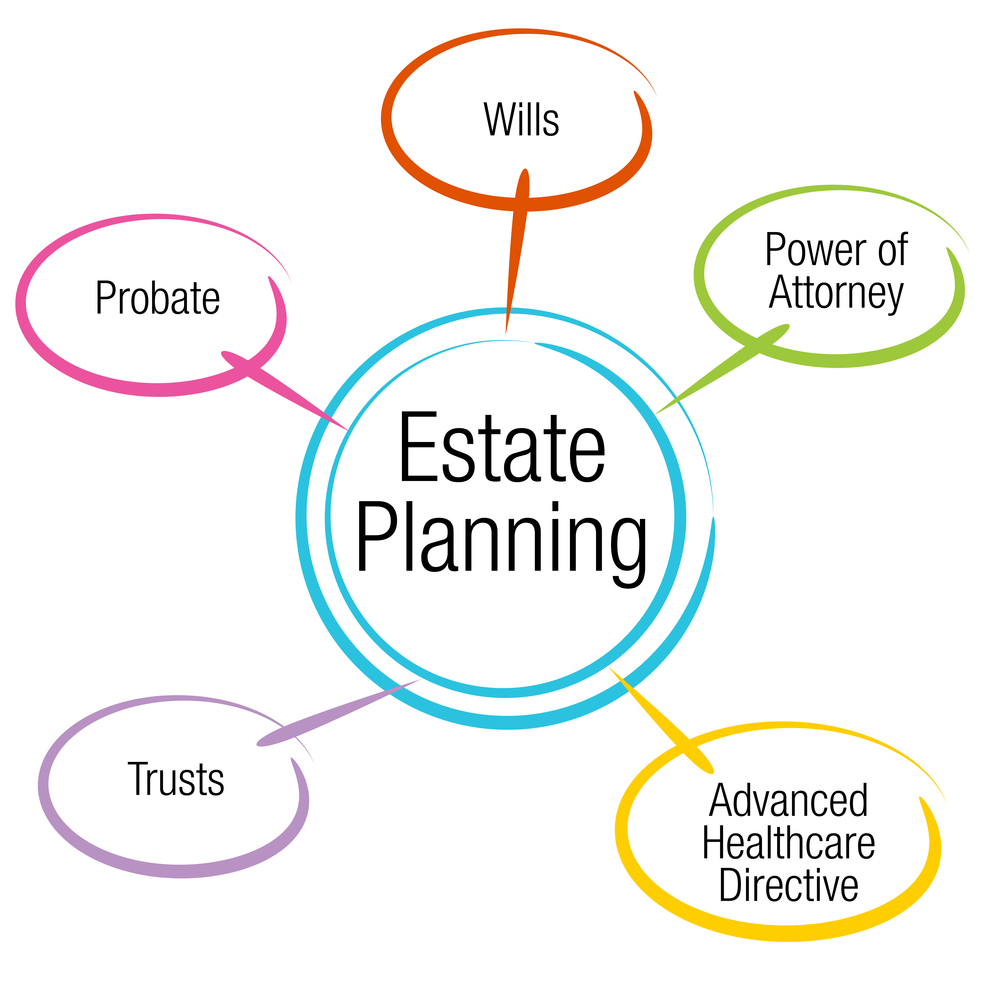

Planning for the Future: Estate Planning for Young Families

Traditionally associated with older people or wealthy families, estate planning may seem like something not for young families. However, it is an essential financial strategy that every young family should consider. Early planning can provide financial independence and security for your loved ones, ensuring that your assets and possessions are distributed according to your wishes after death.

How to Prep Your Finances for a Last-Minute Summer Vacation

Summer vacation is a time of relaxation and fun. But sometimes, our plans can change abruptly, and we find ourselves planning a last-minute trip. Preparing your finances for this sudden expenditure is essential to avoid financial stress and enjoy your vacation fully. Here’s how you can prep your finances for a last-minute summer vacation:

6 Tips For Handling Taxes in Retirement

Retirement is a stage in life that many look forward to. However, it comes with its own set of financial challenges, among them being the handling of taxes in retirement. Contrary to popular belief, tax responsibilities do not necessarily cease once you retire. Your tax liability may increase if your retirement income sources are not tax-efficient. Understanding how to manage taxes during this period can go a long way in helping you maintain a suitable standard of living.

Legacy Planning and What It Involves

Legacy planning is a comprehensive process that covers traditional estate planning activities such as trusts and asset distribution and includes broader considerations, such as how a person wants to be remembered.

5 Reasons You Need Life Insurance

Life insurance is a fundamental and essential component in any comprehensive financial plan. It instills a sense of security in the policyholder and their dependents.

The Benefits of Long-Term Care

Long-term care is an essential component of healthcare that aids individuals who are physically or mentally incapable of independent living. While it may seem daunting, the benefits of long-term care can significantly enhance the quality of life for those in need. I can also help with overall well-being. These benefits include personalized care, safety, and social interaction, among several others.